Personal Insurance Cover

Designed by You.

Whether you are a professional person, a self-employed business owner or someone who aspires to a fulfilling life, you want to protect your lifestyle and those closest to you. And we want to help you design insurance that’s practical, affordable and tailored to your unique circumstances, so that you have peace of mind when it matters most.

To help you make confident, informed decisions, here’s what you need to know:

Start Your Insurance Plan

Let’s start with your details so we can discuss your options in confidence.

Why Insurance Matters.

Whether you are a professional person, a self-employed business owner or someone who aspires to a fulfilling life, you want to protect your lifestyle and those closest to you. And we want to help.

Understanding why you need insurance is simple; just ask yourself “what if?” What if your family income is materially impacted by death, disability or serious illness?

Financial advisers not only assist clients implement appropriate insurance cover, but we are also there for our clients should the unfortunate happen, and a claim is made. Seeing insurance “do its thing” at these critical times is what motivates us to ensure that you have the right protection in the first place.

How Does Life Insurance Actually Work?

Life insurance is essentially “collective risk sharing”. Everyone who buys a policy pays premiums into a central pool of funds managed by the insurer. When a policyholder dies, becomes disabled, or suffers a critical illness, claims are paid out from this pool.

Premiums are priced according to the level of risk each person brings to the pool of funds taking into account factors like age, health, occupation, and lifestyle. The insurer must manage the pool of funds to ensure that there are sufficient funds in the pool to meet all obligations when needed, including long-term income protection claims which could be until age 65. That involves accurately pricing premiums for the risk they take on. Policy features, options and definitions all impact premiums because they impact the risk to the pool of funds from which claims are paid.

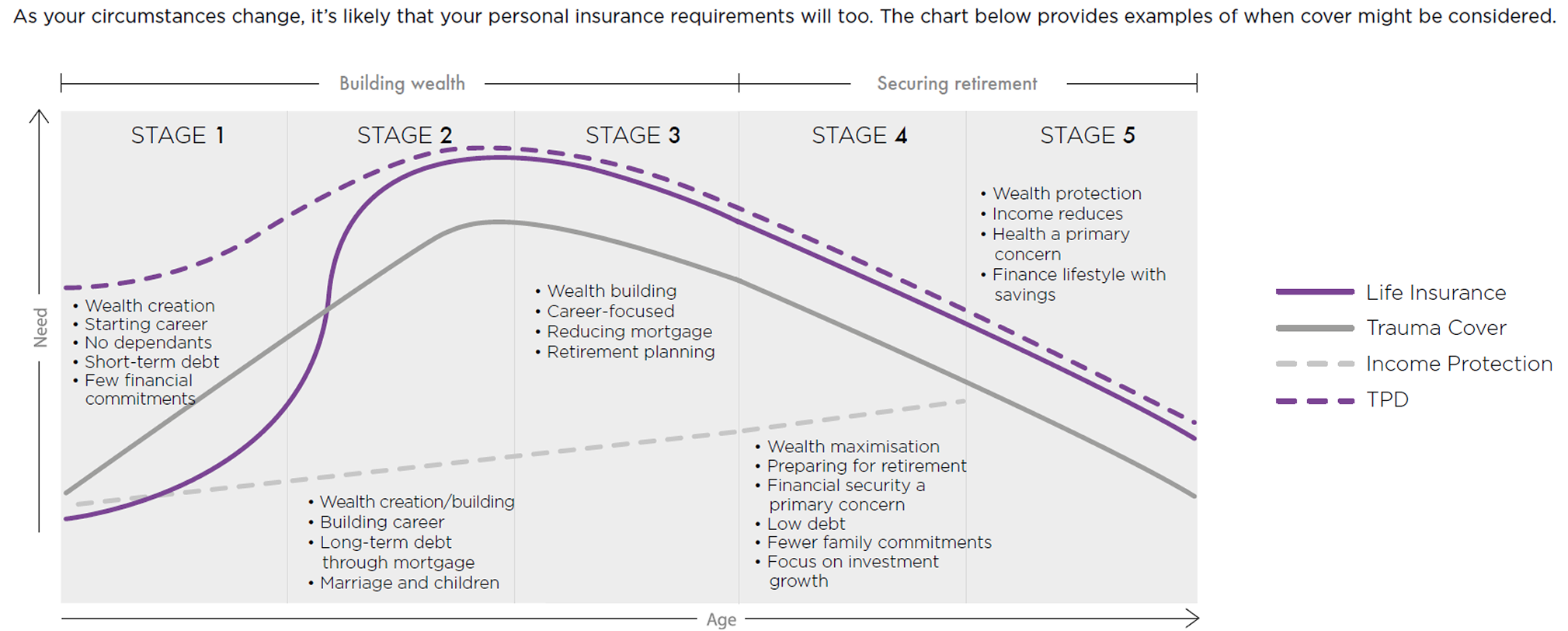

What Are the Life Stages Where Insurance Is Needed?

What Our Clients Say.

What Are Some of the Common Misconceptions?

Insurance companies never pay out, so why should I bother?

In the 2023–24 financial year alone, Australian life insurers paid out over $4.7billion to 54,357 customers in Life, TPD, Trauma and Income Protection claims. Living benefits, that is Trauma and Income Protection claims made up 74% of payouts.

My employer provides me with free insurance, why would I choose to pay extra cover?

This is a one-size-fits-all offering as well and often has some additional risks.

If your employer changes underwriters, will the new underwriter cover pre-existing conditions which would have been covered by the previous underwriter?

If you leave your employer can you take the policy with you and if so, is it subject to underwriting? Will it be priced fairly?

Is the Income Protection benefit only 2-years?

Even where the insurance is free, occasionally clients decide to maintain their own insurance independent of their employer’s offering.

I am young and healthy, so I don’t need it.

Whilst it is true that the likelihood of an event leading to a claim is less likely when you’re young, health including mental health, can change unexpectedly. Accidents can happen at any time. Premiums for young adults reflect this lower risk and are very affordable.

I’m too busy at the moment — should I worry about life insurance later?

All clients are very busy and if you wait until you’re not, you will never be covered, which exposes you and your family to significant financial risk. Just think about the ‘what if?’ question.

I don’t need life insurance because I have no dependents.

If you are unable to work you will be unable to fund yourself; think of your mortgage, living costs. How would you get through an extended period with no income?

Life insurance claims take a long time to pay out.

While some claims can take time, most are straightforward and paid out within a few weeks.

Part of our role is to assist in the claims process and assist with negotiates.

My business can carry on without me until I get back on my feet.

Businesses don’t run themselves. Efficiency and customer services will fall away and your competitors will pounce. Keyman insurance can help protect your business but it isn’t the only strategy you will need to keep your business viable.

I have insurance in my super; why do I need anything else?

Default cover insurance inside super is a one-size-fits-all proposition and is rarely adequate for client’s individual specific needs.

I have had my insurance for many years and it’s OK.

Insurance isn’t a “set and forget” decision as your life and financial responsibilities change. Regular reviews help ensure your policy still fits your needs, protects you when it matters most and is cost effective.

I don’t have a mortgage so why do I need it?

If you are unable to work you will be unable to fund your entire life not just your mortgage. You will be totally dependent on family and/or welfare.

Insurance is too expensive.

The cost of life insurance varies widely depending on age, health, occupation, lifestyle, and the level of cover and features chosen. Many policies can be quite affordable, especially when looked at on an after-tax basis. Our role is to ensure that the cover is not just effective but also cost-effective to your satisfaction.

If I have a pre-existing medical condition, I can’t get life insurance.

Insurers offer cover to people with pre-existing conditions, sometimes with exclusions or higher premiums. Exclusions don’t always apply across all four policies. A “preassessment” can get feedback from multiple insurers very quickly.

My spouse doesn’t work, so we don’t need to cover him/her.

If your spouse is unable to perform normal family and household duties either you will have to undertake those duties putting you under pressure or you will need to hire housekeepers and/or nannies.

I only need to protect my family, not my business or business partner.

What will happen if you or your business partner dies or is totally and permanently disabled and can never work or contribute to the business again? Do you want to have his estate and/or spouse as your business partner? They will be entitled to a share of the company and its profits but what can they contribute? One solution is an insurance funded buy/sell agreement.

Do you have a keyman without whom the business won’t operate efficiently? What will be the financial impact on the business? One solution is keyman insurance.

What Are the Different Policy Types?

There are four policy types which protect different aspects of your financial life: Life, Total and Permanent Disability, Trauma/Critical Illness and Income Protection.

Life Insurance

It covers repayment of your mortgage, investment loans, future living costs, school/university fees, car leases, consumer finance and funeral expenses by paying a lump sum to your family/beneficiaries if you pass away or are diagnosed with a terminal illness.

Total and Permanent Disability (TPD) Insurance

It covers repayment of your mortgage, investment loans, living costs, medical and rehabilitation expenses, modifications to your home to accommodate your disability, and continuing income by paying a lump sum if you become totally and permanently disabled and can never work again.

Trauma (Critical Illness) Insurance

It is designed to fund medical costs, non-medical costs associated with your illness, supplement loss of income if you’re diagnosed with a specified serious illness to the prescribed level of severity. Whilst there are many illnesses covered, the main ones are cancer, heart attack and stroke.

Income Protection Insurance

It replaces 70% of your income and 100% of your superannuation contributions which then allows you to continue to pay mortgage or rent payments and living expenses by providing ongoing monthly payments if you’re unable to work due to illness or injury for an extended period. Because only 70% is covered (and that is taxable) Trauma cover can in some circumstances provide a supplement.

How Do They Work Together?

Each policy type addresses a different risk, and when combined, they create a financial safety net for a wide range of life events. However, these policies are designed to work together as follows:

- In addition to covering significant medical costs associated with serious illness, trauma cover can also be used to supplement income during recovery.

- If you are Totally and Permanently Disabled, you will almost certainly be entitled to an income protection claim. Therefore, the living costs component of this cover can be reduced proportionately resulting in more affordable cover.

- Some policies can be held inside/outside super in combinations that meet your tax and cash flow needs.

- By “linking” Life and TPD cover you can ensure that you are not over-insured, thereby controlling the overall cost of your policies.

How Do We Help You

Design Your Cover?

- We listen to what is concerning you and explore the “what if?” until we are both clear on what needs to be covered.

- We document your financial circumstances and the agreed cover levels in a Fact Find.

- We research appropriate products, their features and combinations thereof, including ownership structures and tax effects to achieve the minimum after-tax cost. We check-in with you to make sure the cost effectiveness is acceptable.

- We document this in a Statement of Advice for your consideration.

- We guide you through the application and underwriting process and negotiate with the underwriters on your behalf where required.

- We review your cover with you as required to ensure that it continues to be cost effective on an ongoing basis.

Who We Are

Craig Lindner

Director & Adviser

Email: craig.lindner@granitefs.com.au

Ramel Remoreras

Advice Assistant

Email: ramel.remoreras@granitefs.com.au

Manuela Bruzzese

Administration Support

Email: client-inquiries@granitefs.com.au

Still Have Questions?

We’re here to make insurance simple and give you peace of mind. If you’re unsure about what cover you need, how policies work together, or just want a second opinion, we’re ready to help. Get started today and discuss your options with us in confidence.

Insurance Cover

Designed by You, for You.

We help families, self-employed owners, and growing businesses design insurance that’s practical, affordable, and tailored to their unique needs, so you have peace of mind when it matters most.